Table of Content

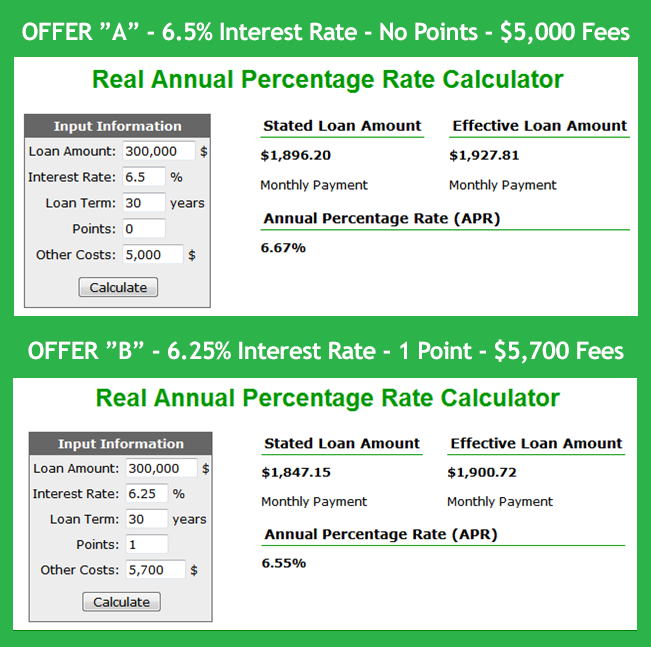

The breakeven point is the amount of time it’ll take to recoup the cost of the discount points required to lower your interest rate. To do the calculation, you divide the cost of the discount points by the monthly savings. Borrowers may be able to find a lower interest rate by shopping around rather than accepting the first loan offered. It is possible to reveal to each lender that another is offering a better rate as a negotiation tactic. While getting a good rate is important, be careful about specific conditions and any additional costs.

For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower. Mortgage rates fluctuate frequently, so what’s considered “good” changes over time. While you can compare mortgage rates online, you’ll also need to compare quotes specifically tailored to your situation in order to find a good rate.

How Much Does 1 Point Lower Your Interest Rate?

For people who have home equity lines of credit or other variable-interest debt, rates will increase by roughly the same amount as the Fed hike, usually within one or two billing cycles. That’s because those rates are based in part on banks’ prime rate, which follows the Fed’s. Eventually, rising rates could make it harder for those households to pay off their debts. Before rates started rising, around a third of gross household income was needed to service a mortgage, according to data analysis by CoreLogic and ANU Centre for Social Research and Methods. Increasing the serviceability buffer for borrowers is generally unpopular among those who make money from property sales, but it's something Brisbane buyer's advocate Wendy Russell supports.

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022. Check your eligibility and the latest interest rates to see if locking in a mortgage and buying a home is right for you. With housing costs growing at such a rapid rate, inflation reached 6.8% in November and hit its highest level since 1982.

How Do I Qualify for the Lowest Mortgage Rate?

Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator. In July, home prices fell for the first time since March 2012, according to the S&P CoreLogic Case-Shiller index which tracks changes in real estate prices. The housing group Redfin also reported the number of homes sold had decreased by 23% year-on-year in July. Some buyers might be tempted to wait on lower interest rates — or slower home price growth — before they enter the market. The interest rate, on the other hand, can be fixed or adjustable, and only accounts for the cost of borrowing the loan.

Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Because most rate-locking programs only last 60 or 90 days, it’s important that you don’t lock in your rate before you’re truly ready to search for and purchase a home. Before you decide on rate locking or a certain loan program, it’s in your best interest to speak with a professional. In other words, mortgage rates drop when inflation seems under control. Given the uncertain future, is this a good time to buy a home, either a first-time home or a bigger home for a growing family?

Are there limits to mortgage buydowns?

One argument is that a tight labor market fuels wage growth and higher inflation. Higher rates mean that safe assets like Treasuries have become more attractive to investors because their yields have increased. That makes risky assets like technology stocks and cryptocurrencies less attractive. Even before the Fed’s latest move, credit card borrowing rates had reached their highest level since 1996, according to Bankrate.com, and these will likely continue to rise. Fed Chair Jerome Powell has acknowledged that aggressively raising interest rates would bring “some pain” for households but that doing so is necessary to crush high inflation. Wednesday’s rate hike, part of the Fed’s drive to curb high inflation, was smaller than its previous four straight three-quarter-point increases.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.

Contents

Longer-term loans, such as 30-year mortgages, come with a higher rate, but lower monthly payments. This is in part because you’re repaying the balance back over a longer period of time. For a 30-year, fixed-rate mortgage, the average rate you'll pay is 6.60%, which is a decline of 3 basis points from one week ago. (A basis point is equivalent to 0.01%.) Thirty-year fixed mortgages are the most common loan term. A 30-year fixed mortgage will usually have a greater interest rate than a 15-year fixed rate mortgage -- but also a lower monthly payment.

But mortgage rates are unlikely to go much higher than 7%, according to Bank of America managing director Jeana Curro, who tracks the housing market for the bank. At the moment, Curro said, lenders are demanding a higher premium because of the volatility financial markets have been experiencing, and the price uncertainty that such volatility causes. As of May of this year, the average median price of a home in the U.S. climbed to $414,200, the NAR data shows. Accounting for the higher mortgage rates, which reached a 6.7% average this week, the monthly payment would be about $1,842 — an increase of 53%. In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees. If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage .

That’s because home loans are packaged as bundles of securities and sold in the bond market. Global and national news events steer bond prices higher and lower, and mortgage rates move similarly in response. Your credit score, and loan-to-value ratio , and are the most important factors lenders use to calculate your mortgage rate.

In order to find the best home mortgage, you'll need to consider your goals and overall financial situation. A lot of first-time homebuyer programs — such as statewide and local down payment assistance — can help you come up with a bigger down payment. According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings. You’ll also need to pay for utilities, likely including water, sewer, gas and electricity.

Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information. NextAdvisor may receive compensation for some links to products and services on this website. If they request a conventional loan, or a government fixed-rate loan program.

When applying for a home loan, one of the most important factors you should pay attention to is your interest rate. Having a lower mortgage interest rate could save you tens of thousands of dollars over the life of your loan. Locking in low mortgage and refinance rates can save you thousands of dollars over the life of your loan. Let’s say you’ve purchased a new home for $500,000, and you’ve put down 20 percent, or $100,000 as a down payment. That means you’ll have secured a loan for the remaining $400,000.

No comments:

Post a Comment